Check out this guest article from Mariel Diaz. Her financial tips for jewelry business owners will help you keep your business on track and earning money.

Learn how to identify the 10 Cash Flow Culprits lurking in your jewelry business and how to improve or eliminate them.

- Debt

- Inventory Turnover

- Impulse Spending

- No Budget

- No Operation Savings

- Timing between Receivables and Payables

- Lag Time between Order Fulfillment and Payment Receipt

- Poor Bookkeeping

- Low Sales

- Unworthy Expenses

1: Debt

The Worst of the Four-Letter Words. Debt is a thief because it fools you into thinking you have more than you do. This masked caper attacks when you don't pay off purchases in full as they are made. Once a couple cycles occur of not paying off a credit card in full or purchasing more than you can afford, you become a cat chasing its tail.

If you are using the credit to purchase regularly occurring expenses, then those costs snowball into more debt. If you weren't able to pay them last month, then you're likely not going to pay last month and this month together. Before you know it, you're paying for expenses you purchased 18 months ago, burdened by interest and the continuance of new expenses.

Create a snowball to your advantage by following the Debt Snowball Method from Dave Ramsey. This helps you have a small victory to help motivate you from the start.

"The debt snowball method is a debt reduction strategy where you pay off debts in order of smallest to largest, gaining momentum as each balance is paid off. When the smallest debt is paid in full, you roll the money you were paying on that debt into the next smallest balance."- Dave Ramsey, author of 7 national best sellers and host of the Ramsey Show

2: Inventory Turnover

If you don't operate with just-in-time inventory, then you may find your Inventory Turnover is sucking your cash. Just-in-time Inventory is where you have just enough on hand to meet demand and order more as orders are placed, but you aren't keeping a stockpile.

To see how much cash you have in inventory, look at your Balance Sheet for Inventory Asset if your books are kept to date with Inventory and Cost of Goods Sold adjustments. (BenchWorks does this automagically for you in Xero!)

If you can't look at your Balance Sheet, look at your most recent tax return, find page 2 of Schedule C Form 1040. What is your Ending Inventory? That will give you a close idea, plus purchases, minus sales since then.

If you have items you may have an idea for one day... or the time to create something with it one day..., then consider Inventory Turnover as one of your Cash Flow Culprits!

Embrace what you already have to create income. Sell what you've got!

Remember those emotions that got you to buy it in the first place? Channel that into creating something new and saleable now, or convey those emotions to a buyer.

Keeping track of what you have on hand and available for production or sale means that you have assets that can easily convert to cash. Analyze how fast you are selling your inventory by dividing your Sales Income for a given period by the average Inventory Cost on hand for the same period.

Once you know where you sit with your Inventory Turnover ratio (anything higher than 1 is great in the jewelry industry), then you can consider ways to improve. A real motivator is to calculate how much income you can create from what inventory you have.

- Will you sell it wholesale?

- Will you sell it retail?

- How much can you bring in?

Do it now! You've already got the goods willing and waiting to generate an inflow of cash to your business.

3: Impulse Spending

The best way to make an investment is by planning out your purchases and saving up for them. Yes, the old-fashioned way, before the I want it and I want it now era.

Impulse spending is the death of a budget. If you don't know where your money is going, before it's gone, then it's gone, and you don't know where it went.

As jewelers, you're already prone to be attracted to pretty things, so when it's thoughtful and creative, it can be difficult to hold you back. Retain yourself! I demand you! Do not lose your sanity in exchange for things.

Own your business, don't let it own you!

A good rule of thumb: If you don't have a buyer, don't buy it.

"Saving money isn't about depriving yourself. It's about deciding you love Future You as much as you love Today You."- Chelsea Fagan, The Financial Diet

4: Not Operating on a Budget

When you want to be in control of your money, use a budget. I can't imagine you don't want to be in control of your money, right? Right. So, it's as simple as that. Always, every day, use a budget.

The method behind a budget is assigning every dollar of income to a job. You have to create a starting point, but then navigate and adjust each day with what is actually happening.

- Not creating as many sales as you anticipated?

- What are you going to cut or how will you pump up the sales before the month is over?

- Something cost more than you budgeted for?

- Play see saw from other expenses by cancelling other costs to pay for it, or else you can't buy it.

Budgets are discipline and discipline is freedom.

The harder you are on your finances, the better off you will be. Let go of the idea that a budget is restrictive. Budgets are liberating! As soon as you can sort all of your income into buckets to cover all of your expenses, savings, and investments, the better.

5: Not having Operational Savings

If you don't have savings of 3-6 months of expenses and a buffer on your Checking account, it's time for a change.

A buffer is a cushion on your checking account, so that when life -as it may be- has a few unexpected expenses pop up, you aren't dipping into your savings or scrambling for money.

A buffer protects against minor cash-flow fluctuations and should be at least 25% of your monthly income or up to 8 weeks of expenses. Anything over that should go to a higher interest savings account.

6: Timing between Income Received and Payments Due

Eliminate your risk of timing issues on your cash flow by using a budget and forecast all upcoming expenses. This way you will know exactly how much you'll need each week and day in the bank to cover all recurring expenses and one-time payables.

7: Lag Time is Slash Time

A business owner can be led into desperation between production time, shipping, receiving a payment, and the merchant and bank's processing times. Slash the lag time between each of these by studying your procedures.

Like other timing issues, lag time between payment processing and when you have to deliver the goods can make a huge impact on Wholesalers and Custom Jewelers.

Guardians against the lag-time culprit include:

- down payments

- payment terms for when the balance is due and how quickly you get paid

- how the payment is processed, such as cash, check or credit card

8: Poor Bookkeeping: Not up to date; not reliable

For example, if we are in January 2019, a 12-month side-by-side comparison of expenses will show you Jan - Dec 2018. This allows you to review what happened in the past to see what expenses are may be expected in the future.

When your bookkeeping is up to date and complete, you can rely on the information the reports are telling you. Without reliable reports, there is no reason to run them.

9: Not Enough Sales

If you aren't meeting your sales goals, or worse yet, haven't established sales goals to chase, then it's time for a check-in. You'll need to review where you've been and plan where you want to go. To get to where you want to go, and more immediately, to fund outflows of current cash, you'll need to figure out what you can do to make those sales.

- How many pieces do you need to sell to generate the amount you need?

- Who can you contact to help you, or to sell to?

- What events or promotions can you do?

Because you're a business owner or a member of a business that relies on sales for income that is not a predictable pay check, motivating sales every day has to be part of your agenda.

Cash flow can't flow out, without an inflow. You just have to go out there and ask for the sales. Accept that it is your right and purpose of the business to have sales.

10: Expenses Without a Return

It's great to make investments in your business with the hopes of generating a return, but are you getting the return you hoped? You've probably heard the saying, "cut the fat." There are really only two ways to improve cash flow: increase income and reduce expenses. While there are many ways to do both of those, keeping your costs in check is the one that makes your business endure the test of time. You can quickly create income to boost your profits, but expenses are the culprit that deplete profits on an ongoing basis.

Cancel any recurring charges you don't need. Keep a running roster of your recurring annual and monthly charges with their renewal dates, so you know at-a-glance if you need to cancel something before it renews.

Get rid of any expenses that you no longer feel are worth it.

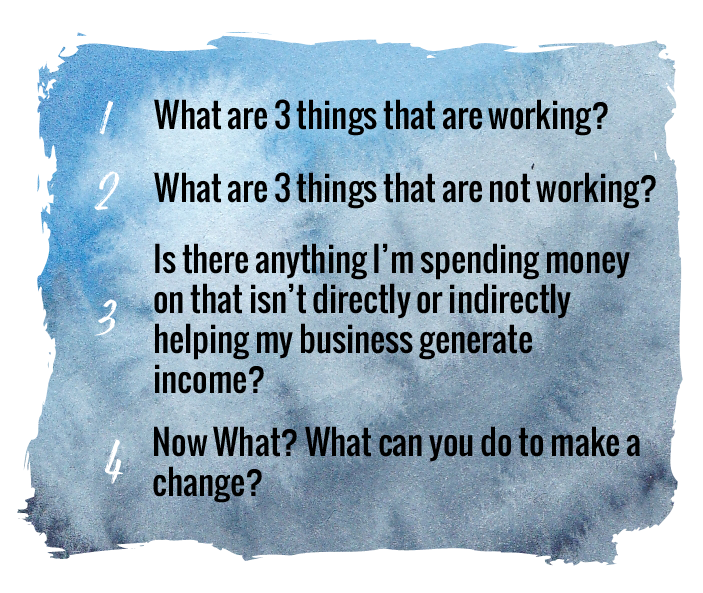

Take time each month to comb through your expenses and ask:

The only way to have cash is to not spend it. Be frugal and discerning with every dollar.

The best warrior against Cash Flow Culprits is a budget. We highly recommend using YNAB on a daily basis. You can use the Budgeting feature in QuickBooks or Xero if you stick to it. To do so, you have to meet your sales goals and not exceed budgeted expense amounts. Sometimes, it's not that easy, so that's why we depend on YNAB.

Accounting for Jewelers is not affiliated with YNAB, we just believe in it. Our employees use it and many of our clients do too. Click here for my referral link to YNAB, so we can both get one month free and nerd out together.

Further reading for jewelry business tips:

How to Start a Jewelry Business

How to Manage Your Time Better Using 7 Simple Steps

Pricing Tips for Jewelry Businesses

Help keep your finances in check with our interactive pricing guide.

|

Mariel Diaz is the Founder and Managing Director of Accounting for Jewelers, where she develops courses and applications, oversees service operations and advises clients to improve the financials of their businesses. Her goal in life is to make a massive impact on the quality of life of jewelry business owners. Check out these great resources for jewelers:

|